Top VCs Reigniting Africa's Tech Ecosystem in 2025

The Return of the Silent Giants

The African tech funding landscape is witnessing a calculated comeback from previously active investors who had significantly reduced their involvement in 2024. This renewed engagement reveals interesting patterns that both startups and fellow investors should note:

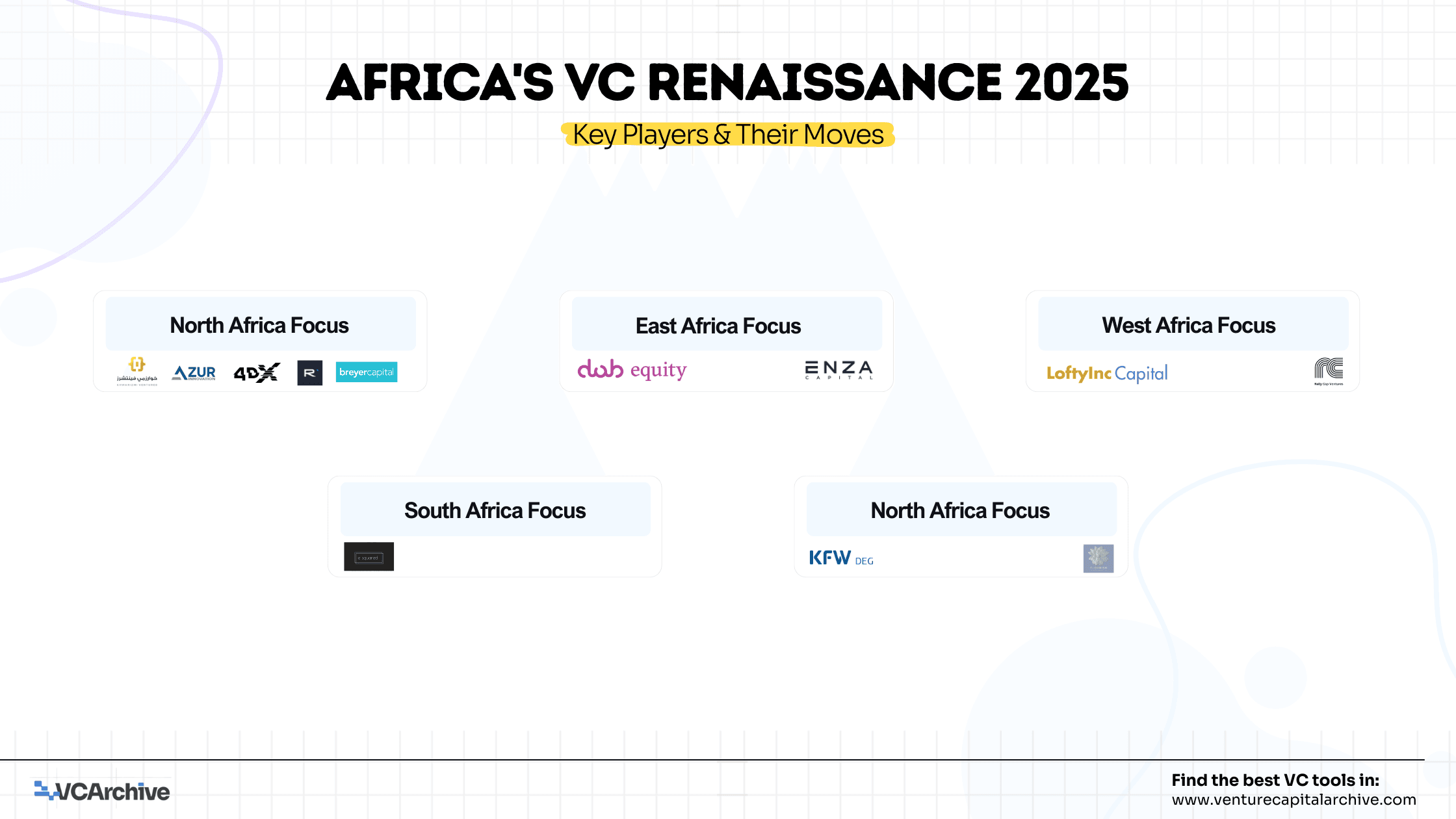

Khwarizmi Ventures

This North Africa-focused VC is reaffirming its commitment to the Egyptian market with a substantial follow-on investment in fintech startup Khazna, participating in a $63 million funding round. After backing promising ventures like Pylon, Bosta, and Chari.ma during 2021-2022, Khwarizmi's recent activity signals confidence in their existing portfolio and the Egyptian fintech sector.

E Squared Investments

South Africa-based E Squared has returned with a significant R126 million ($6.7 million) Series A investment in Khula!, an Agritech startup. This move, alongside major corporate co-investors like Absa Group and PepsiCo, demonstrates E Squared's strategic focus on essential sectors with proven traction.

LoftyInc Capital

This Nigerian VC firm has expanded its geographical focus by participating in a $3 million pre-Series A round for Egypt's Widebot, an AI startup developing an Arabic Large Language Model. LoftyInc is also raising a new $43 million fund (targeting $50 million), indicating renewed commitment to deploying capital across the continent.

Azur Innovation Partners

Morocco's Azur Innovation has emerged as the lead investor in a $1.9 million pre-Series A round for ORA Technologies, a Morocco-based superapp. This investment highlights a focus on strengthening the domestic tech ecosystem and supporting digital inclusion.

KFW DEG

The German development finance institution has pivoted toward larger infrastructure investments, committing €50 million ($52.4 million) to the Facility for Energy Inclusion (FEI) fund, which focuses on renewable energy projects across Africa.

DOB Equity

Despite facing portfolio challenges with failed investments in Sendy and Copia, this Netherlands-based impact fund has renewed its commitment to East Africa by backing Spouts International, a Ugandan company producing ceramic water filters.

4DX Ventures, Raed Ventures, and Breyer Capital

These three previously active investors have all participated in the same $6.75 million pre-Series B round for Egypt's Taager, a social e-commerce platform, demonstrating continued interest in the Egyptian market despite geographical diversification in 2024.

Rally Cap Ventures

After focusing on North and South American startups in 2024, Rally Cap has led a $3.5 million seed round for Guinean fintech Cauridor, which is developing cross-border payment infrastructure.

Flourish Ventures

While Flourish itself had fewer direct investments in 2024, its subsidiary Madica has been actively backing diverse African startups, including Tanzanian telehealth platform Medikea, Egyptian femtech Motherbeing, Tunisian e-mobility startup Pixii Motors, and Moroccan AI voice analytics platform ToumAI.

Enza Capital

Kenya-based Enza Capital has joined LoftyInc in backing Egypt's Widebot, showing resilience despite previous portfolio challenges and indicating interest in both the Egyptian market and AI technologies.

Key Trends Defining the 2025 Investment Landscape

his renewed activity reveals several important trends for the African tech ecosystem:

- Strategic Follow-on Investments: Nearly 42% of the investments made by these returning VCs are follow-on rounds, indicating a focus on supporting existing portfolio companies rather than making entirely new bets.

- Sector Concentration: Fintech continues to attract significant attention, but we're also seeing increased interest in AI, agritech, and renewable energy solutions.

- Geographical Shifts: Egypt is emerging as a particularly attractive market for returning investors, with multiple deals across different sectors.

- Measured Optimism: The pace and scale of investments suggest a more cautious approach than the frenzied activity of 2021-2022, with a stronger emphasis on sustainable business models.

- Cross-border Collaboration: Many rounds feature a mix of local, regional, and global investors, creating stronger international investment networks.

Implications for the Ecosystem

The return of these "silent VCs" brings more than just capital—it signals renewed confidence in Africa's tech potential while acknowledging the lessons learned from 2024's funding winter. For founders, this means focusing on sustainable business models and traction will be crucial for attracting investment. For investors, collaborative approaches and strategic sector focus appear to be the winning formula.

While we may not immediately return to the peak funding levels of 2021-2022, this more measured approach could ultimately lead to a healthier, more sustainable growth trajectory for the African tech ecosystem. The emphasis on follow-on funding also highlights the importance of relationship-building and demonstrating tangible progress to secure ongoing investor support.

As we move deeper into 2025, monitoring how these investment patterns evolve will provide valuable insights into the long-term direction of Africa's tech landscape. One thing seems clear: the continent's technological potential continues to attract strategic capital, even after a challenging period of reassessment.